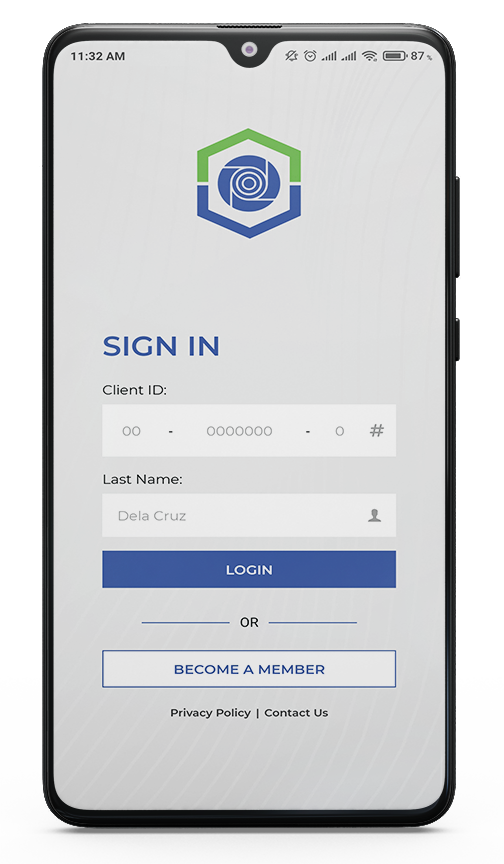

Credit

Need cash for immediate expenses? Apply for your desired loan according to your purpose and get money you need with PHCCI.

Appliance Loan

A loan for the acquisition of brand new household appliances including personal computer and laptop.

Maximum loanable amount is PHP50,000.00.

Maximum term is two (2) years.

With an interest rate of 1% per month.

Calamity Loan

A loan window for members residing in an area declared as under the state of calamity or directly affected by fortuitous event or natural calamity.

The member must have a rating of A or A-.

The maximum loan amount is fifteen thousand pesos (P15,000.00).

Emergency Loan

A loan window where the amount is equal to or less than the share capital upon application.

A collateral is not required.

Motorcycle Loan

A loan window for the acquisition of brand new motorcycle.

Maximum loanable amount is PHP100,000.00.

Maximum term is three (3) years.

With an interest rate of 1% per month.

MCH/Multicab Loan

A credit service specially to members who are motorcab/multicab for hire operators.

The maximum loan amount is fifty thousand pesos (PHP 50,000).

Personal Loan

A personal loan can be availed by members who are home-based employees, regular employees, and self-employed for additional fund, personal or business use.

Maximum loanable amount for this loan is PHP 1,000,000; Member must be at least 21 years old on the date of application.

Auto Loan

A type of loan for the purchase of brand new or second hand vehicle.

The applicant must have capacity to pay based on CIBI and must not be more than 69 years old upon maturity of the loan.

The maximum loan amount is P3 million.

Interest rate is 8.25% per annum (Straight Line); 15.6% per annum (Diminishing)

Capacity Loan

A type of loan that requires share capital of at least five percent (5%) of the amount of loan applied.

Real estate property/ties is/are required as collateral/s.

Grocery Loan

A loan window that is zero-interest.

The applicant must have been a regular member of PHCCI for at least six (6) months upon application.

The applicant must have availed of any loan products of the cooperative with a loan rating of at least A-.

The maximum loan amount is four thousand two hundred sixty pesos (PHP 4,260.00), payable in two (2) months.

A collateral is not required.

Regular Loan

A loan window where the loan amount is more than the share capital, but not to exceed two hundred (200%) percent.

Collateral/s will be required to cover the exposure (beyond PHP10,000.00) carried by the cooperative.

Family Medical Insurance Loan

A type of loan for members who want to avail of family hospitalization insurance with coverage of PHP 20,00 per year.

Members must not be more than 69 years old upon application. He/She can nominate at least 4 beneficiaries. Maximum loan amount is PHP 2,250

Business Enhancement Loan

A loan window for entrepreneurs or businessmen/women who are in need of additional working capital for their business.

The maximum loanable amount is PHP200,000.00.

The required share capital is fifteen percent (15.0%) of applied loan amount upon application.

Must have a business registered and operating profitably for at least two (2) years.

Educational Loan

A loan members can apply for the payment of tuition fees.

he loan amount is more than four times the share capital upon application.

Maximum loanable amount is PHP100,000.00.

Maximum term is ten (10) months.

Instant Loan

A loan window with a maximum loan amount of ten thousand pesos (PHP10,000.00) on top of any other existing loan.

It is renewable anytime provided that any unpaid amortization due within the 30-day grace period shall be deducted from the proceeds.

The applicant must be a member in good standing (MIGS).

Salary Loan

A type of loan granted only to active regular employees.

The maximum loanable amount may vary depending on the available net take home pay of the applicant less any mandatory deductions by the employer and the Cooperative.

The maximum term varies depending on the company/institution/organization the member is employed.

Financing Loan

A financing loan can be availed by members who are planning to purchase vehicles with year model not more than 10 years but not below 5 years.

Maximum financing loan is five times (5x) the amount of your share capital or PHP 500,00, whichever comes first. Members who want to apply must be not more than 65 years old on the date of application.

PHCCI offers affordable loan interest rates.

Acquire this budget friendly loan interest. Not yet a member? Attend our Pre-membership Education Seminar personally or online.